HexTrust Markets and Clearpool have launched the X-Pool, a secure, flexible, and powerful investment vault to earn returns on your idle stablecoin holdings. Deployed on the Flare network, this DeFi vault allows users to deploy USDC, USDT, and USDX into an institutional-grade trading strategy, managed and executed by HT Markets. The strategy executes a blend of T-bills exposure and perpetual futures arbitrage strategy – generating dynamic returns between 8-15% APR, paid out weekly.

Further to the investment strategy, the X-Pool is fully integrated into the Flare DeFi ecosystem through its collateral token, yUSDX. Investors will receive 1 yUSDX for every USD stablecoin deposited. The yUSDX will soon become lending collateral for liquidity provision rewards on other Flare services such as SparkDex.io and Kinetic.markets.

How the Strategy Works

The T-Bill x Futures Arbitrage Strategy is a well-tested, low-risk approach to capture returns without directional crypto price or market cap exposure.

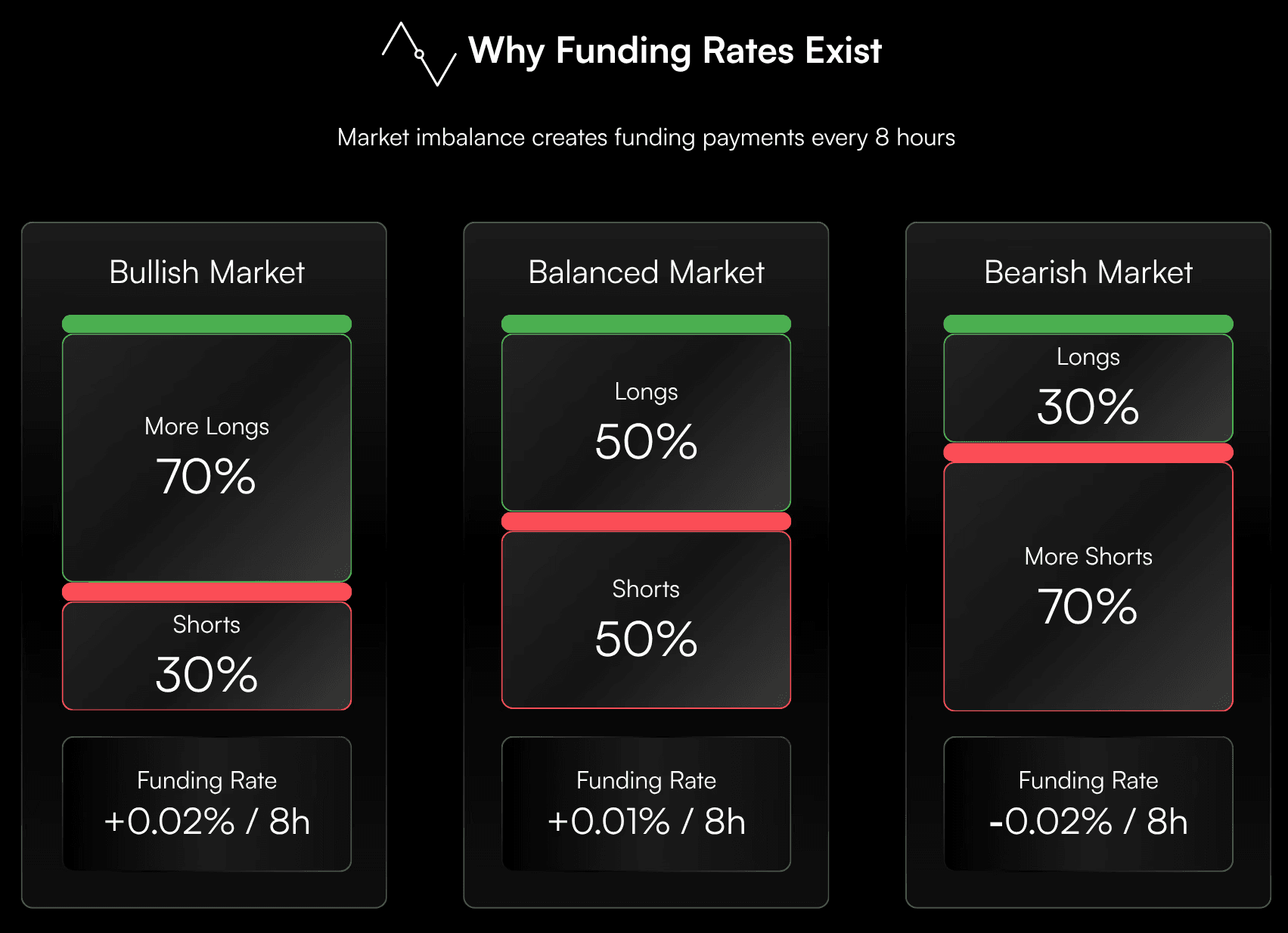

By simultaneously buying an asset on the spot market and shorting a perpetual futures contract, the strategy creates a "delta-neutral" position. Revenue is generated by capturing "funding payments" that are made between longs and shorts in the perpetual futures market.

Yield Source: The dynamic yield is generated by profiting from funding payments in perpetual futures. The target annual yield ranges between 8-10% APR, with potential to reach up to 20% in high-volatility environments.

Besides the delta-neutral perpetual futures arbitrage strategy, the investment manager may also allocate a variable portion to short-term US Treasury bills. It is important to note that these yields are dynamic and may change due to market conditions.

Strategy Execution: The execution of the strategy is ensured through delta-neutral positions. This means that every position is hedged to ensure the overall value of the asset portfolio remains neutral to price fluctuations, thereby reducing market volatility risk. T-bill exposure is managed through HT Markets accounts with a reputable, Tier 1 TradFi brokerage service.

How to Subscribe and Redeem Funds

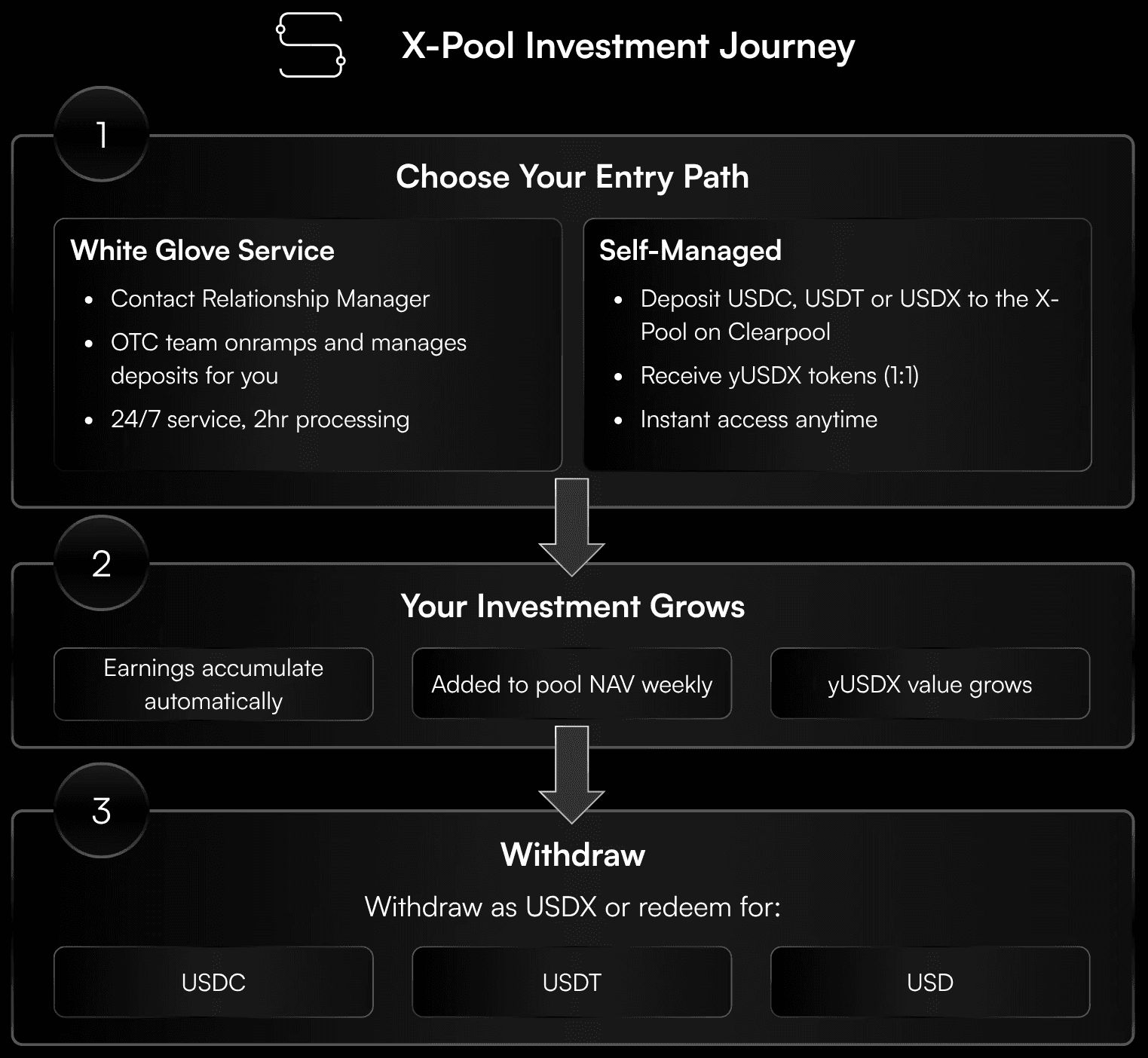

Investors are presented with two distinct avenues for subscribing to the X-pool:

Hex Trust White Glove Service: Clients of Hex Trust may initiate a subscription to the pool through their Relationship Manager or designated business chat. The Hex Trust OTC team will subsequently request the requisite funds and execute the deposits into the vault, along with the secure custody of the collateral token, yUSDX, until its redemption is requested. Hex Trust's service operates on a 24/7/365 basis, with funds typically credited to the pool within a two-hour window.

Self-managed Investment: Any user is permitted to deposit funds into the X-Pool via Clearpool at any time through its online portal. For each dollar of stablecoin lent, investors receive one yUSDX, which functions as a Liquidity Provider (LP) token.

Yield Attribution: All accrued yield automatically accumulates within the vault and is subsequently deposited into the pool's Net Asset Value (NAV) on a weekly basis. The intrinsic value of yUSDX held by users appreciates in direct correlation with the returns generated by the underlying investment strategies.

Withdrawals: Withdrawals are processed in USDX and can be exchanged for USDT, USD, or USDC at a 1:1 ratio through redemption with HT Digital Assets, or through exchanges such as Bitmart, SparkDex, and Curve.

Withdrawals are processed sequentially and may require up to 72 hours for completion. This processing period is necessitated by the unwinding of the underlying investment trades.

Information and Disclosure Regarding the Strategy's Risks

While the described strategy aims for delta-neutrality and exhibits a low correlation to crypto market spot prices, potential investors must understand the associated risks. The product documentation outlines the following risks and HT Markets' mitigation strategies:

Platform Counterparty Risk: This risk pertains to potential exchange defaults or operational disruptions (e.g., loss of funds, withdrawal freezes). HT Markets mitigates this by diversifying the strategy across three top-tier exchanges (Binance, Bybit, and OKX) and enforcing strict exposure limits.

Funding Rate Compression: The risk of reduced spreads due to crowded trades is mitigated by allocating trades across up to 20 crypto assets based on trading volume and Open Interest. Additionally, the strategy allows for the reallocation of funds into US T-bills if funding rates consistently fall below the T-bill rate.

Market Risk: The risk of execution gaps, where one leg of a trade fills before the other, is mitigated by a proprietary spread algorithm, liquidity filters, and real-time monitoring.

Liquidation Risk: Margin pressure stemming from market volatility is mitigated through conservative leverage (≤2x), excess collateral on exchanges, and 24/7 margin monitoring and alerts.

Operational Risk: The inherent complexity of the multi-step operational flow is managed by an experienced team with over 25 years of expertise, applying robust reconciliation processes and dual-authorization controls.

Liquidity & Maturity Mismatch: The potential for a mismatch between daily client redemptions and the time required to unwind positions is managed by maintaining conservative liquidity buffers, daily monitoring of net flows, and a transparent 48-hour withdrawal queue.

Deposit idle stablecoins and start earning rewards now:

Questions? Contact us!

If you have any questions or would like to know more about X-Pool, please contact:

(A) The HT Digital Assets Team via Email.

(B) The Clearpool team via the Clearpool Telegram or Discord community chats or;

(C) To purchase USDX, please contact HT Digital Assets.